Mi BANK Advantages

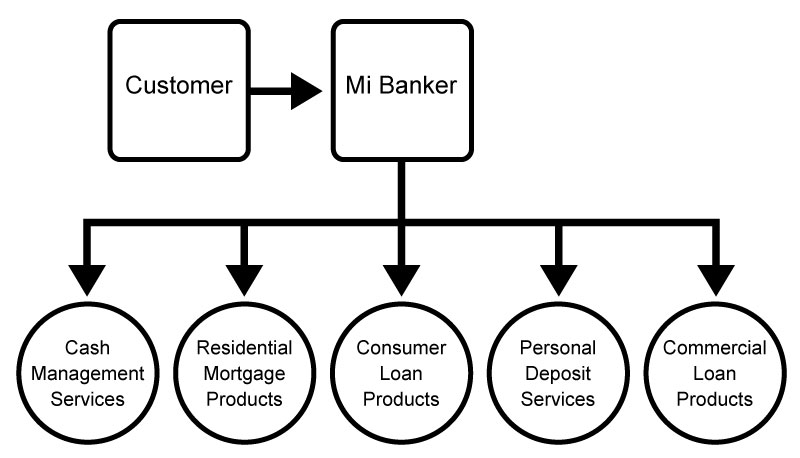

Mi BANK Dedicated Banker

One stop shopping for both your personal and business banking needs.

At Mi BANK we value relationships above all, that’s why we provide each of our clients with their own dedicated Mi Banker.

Benefits:

- All of our products and services can be accessed through your Mi Banker.

- Your Mi Banker knows your business needs and has the flexibility to adapt and create custom-fit strategies to meet your needs.

- You’ll have a direct line to your Mi Banker via phone or email anywhere, any time.

Mi Card

A better card experience is at your fingertips

Ready for an easier way to manage your cards? Our upgraded card experience puts more control, convenience and safety in your hands.

Feel More Empowered:

- Set spending limits based on location, merchant type or transaction type and know where every card is stored online.

Discover More Convenience:

- Easily add cards to your digital wallets and access them 24/7.

Find More Clarity:

- Gain total transparency into every transaction with clear merchant names and keep track of spending.

Feel More Secure:

- Immediately report and turn off a lost or stolen card in a couple of clicks and keep in constant communication with your financial institution with two-way fraud alert.

Mi BANK Business Mobile

Secure access to your account information from your iPhone or Android Smartphone.

Financial Management Tools

- Check Account Balance

- Review Transfers & Payments

- Approve Transactions

- Deposit Checks

Strong Fraud Prevention

- Control large transfers of money

- Helps identify suspicious activity

- Stop fraudulent transactions before they ever happen

Personal Financial Management

AllData® PFM is Mi BANK’s solution that offers you a complete financial picture of your finances.

With access to more than 18,000 data sources, including banking, credit cards, investment accounts, employee stock plans, mortgages and insurance, AllData PFM aggregates account data from virtually any online financial source. Your online banking site becomes the financial hub customers rely on to monitor and manage their cash flow, investments, spending, budget and savings goals.

Benefits include:

- Convenient access to a view of all their financial accounts

- The ability to track savings goals, budgets and spending

- Information and resources to make well-informed financial decisions